Bonus tax calculator 2020

For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document.

Sales Tax Calculator Price Before Tax After Tax More

Self-Employed defined as a return with a Schedule CC-EZ tax form.

. Our Income Tax Calculator tells us that the annual tax due on this amount is R33570. Any bonus or commission payments should be entered so if you expect to be paid 500 commission in the next pay. Usual tax tax on bonus amount.

1 online tax filing solution for self-employed. Entering the bonus in this box will calculated only the additional tax and national insurance the bonus. YourTax Tax calculator Compare yearly tax changes.

Tax tables 2020 Tax tables 2019. Whether you prefer to get help in an office just drop off your taxes or have your tax pro complete them virtually. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Tax on Bonus - How Much Do You Take Home. View All Tax Guides. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

Offer valid for returns. If ITR is not filed by January 31 2022 then the individual will not be able to file ITR for FY 2020-21 unless a notice is issued by the income tax department. Tax calculator 2023 current.

Feeling confident that starting an S Corp is a smart move. Prospects for Federal Tax Policy After the 2020 Election. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

07092022 What Will Chancellor Kwasi Kwarteng Do. View All Tax Guides. Tells me exactly what taxes Ill owe.

Find out the benefit of that overtime. No cash value and void if transferred or where prohibited. 08072020 Stamp Duty Calculator.

Use our payslip calculator to check the correct tax and other deductions have been made fully updated for tax year 2022-2023. Latest Business and Tax News. And a 20 bonus for qualified direct deposits is a great place to start.

Federal Income Tax Calculator 2022 federal income tax calculator. View All Tax Guides. You may be knowing that LIC shares its valuation surplus or profit to the policyholders in the form of Bonus and Loyalty Additions.

How to use the Take-Home Calculator. Click here for a 2022 Federal Tax Refund Estimator. You can use an income tax calculator online to quickly understand your tax liabilityThe income tax calculator is a simple tool that gets updated with the latest rules and regulations and shows you your accurate income tax liability for the yearTo understand how much income tax you need to pay for the financial year ending on 31 st March 2022 use our.

Thandis total tax for March 2020 will then be. If you have a yearly bonus payment you can also add that to your annual salary and well include it in the calculations. Americas 1 tax preparation provider.

The Discover it Cash Back also offers rotating bonus categories and like the Freedom Flex you can earn a total of 5 percent cash back on up to 1500 in bonus category purchases per quarter. The calculator also excludes temporary provisions that were enacted in 2020 to provide assistance to taxpayers during the pandemic such as the 300 deduction for charitable contributions by taxpayers who do not itemize as well as any other changes to the tax code enacted after December 31 2020. Its issuing plus-up payments for individuals who now qualify for more money based on their 2020 tax return.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. ANNUAL BONUS - If you received a bonus payment in the tax year selected you can either enter it by adding it to the gross income provided or by entering it in this box. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

Bounce Back Loan Calculator 3511 views. Receive tax filing assistance from an HR Block tax professional. LIC Bonus Rates 2020 2021as per 2020 March Valuation All details with charts and illustrations.

Section 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for the temporary allowance of a 100 business meal deduction for food or beverages provided by a restaurant and paid or incurred after December 31 2020 and before January 1 2023. If we now add her bonus amount R10000 to the annual income R240000 her new annual income becomes R250000. LIC of India has declared the latest bonus rates for the valuation period 1 st April 2019 to 31st March 2020.

Standard deduction 12400 for 2020 single filers and Section 199A commonly called QBI. You can deduct the entire purchase with bonus depreciation. Earn a 200 Bonus after you spend 500 on purchases in your first 3 months from account opening.

Therefore the difference is. Please add your yearly dividend income in the Dividend income field and our tax calculator will accurately estimate your. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

The limit was 137700 in 2020. Our tax calculator allows you to compare how the Tax Cuts and Jobs Act and proposals to modify the federal tax code could impact overall. 08072020 Stamp Duty Calculator.

Form 8915-F replaces Form 8915-E. Say its 2020 and you just opened an online t-shirt shop that required the purchase of a 10000 screen printing machine. This calculator applies the following.

R33570 R30970 R2600. Enter your tax profile to discover bonus tax savings. Other income tax deadlines extended.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. 5 cash back on up to 1500 in combined purchases in bonus categories each quarter you activate. Your average tax rate is 217 and your marginal tax rate is 360.

Latest Business and Tax News. Permanence for 100 Percent Bonus Depreciation Provides More Cost-Effective Growth than Permanence for Individual Provisions. As a default the tax code for the latest financial year 20202021 is L1250.

08072020 Stamp Duty Calculator. The IRS will use the most recent tax return on file 2019 or 2020. Bonus pay Career status.

If the tax withholding on your bonus turns out to be higher than necessary you might receive a tax refund for overpayment. Benefit In Kind Tax Calculator 3029 views. Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022 as applicableIn previous years distributions and repayments would be reported on the applicable Form 8915.

A late filing fee of Rs 5000 along with penal interest at the rate of 1 per cent per month will be levied on the non-payment of tax dues in this case. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. A tax calculator for the 2022 tax year including salary bonus travel allowance pension and annuity for different periods and age groups.

2021 2022 Income Tax Calculator Canada Wowa Ca

Ontario Income Tax Calculator Wowa Ca

Tax Calculator Estimate Your Income Tax For 2022 Free

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

What Are Marriage Penalties And Bonuses Tax Policy Center

Avanti Bonus Calculator

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

How To Calculate Income Tax In Excel

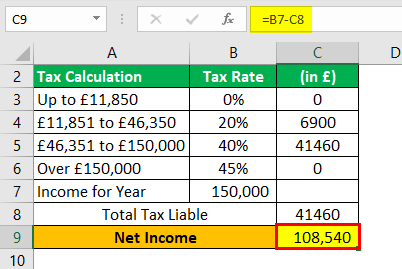

How To Calculate Income Tax In Excel

How And Why To Calculate Your Marginal Tax Rate Deliberatechange Ca

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Progressive Tax Examples Top 4 Practical Examples With Calculation

How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube